What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Wed, 26 Dec 2007

Why should you worry about welfare?

[Appeared last week in the Woonsocket Call, Pawtucket Times and other fine RIMG papers.]

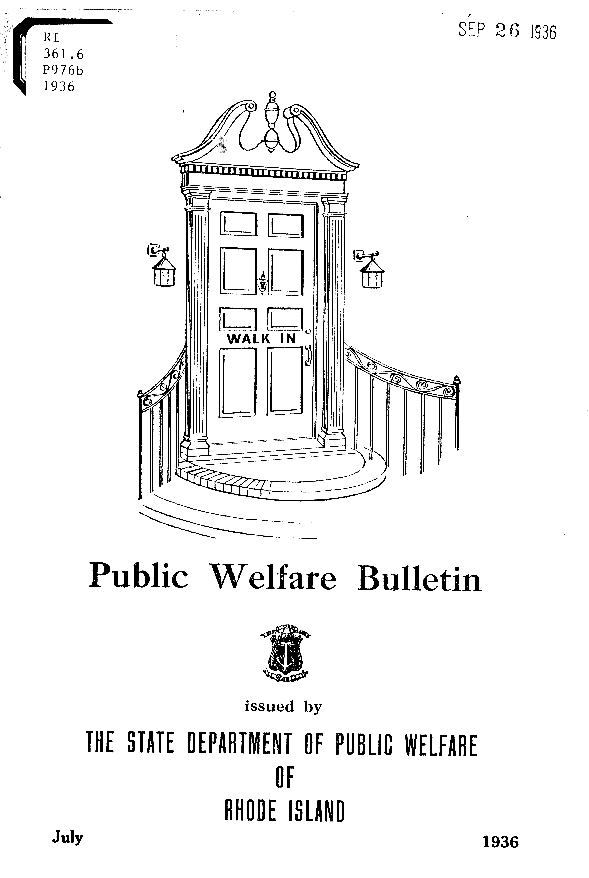

While browsing through old reports at the state house library a while back, I found the 1936 report of the state's Public Welfare Department. The report was interesting, but it was the cover that caught my attention. It's a fascinating image, but what's most fascinating about it is how incongruous it seems in 2007. Just try to imagine some meeting next year of the newly reorganized Human Services directorate, where an artist proposes this as a cover for their first annual report. When the laughter finally subsides, the new director will lean over and, with teeth clenched, inform the artist that meetings are not for drollery.

But what, exactly, is so strange about it? I spent a little while with my friend Google, browsing welfare department (ahem, "Human Services") logos in various states and cities. What you find these days is lots of little stick figures representing, I suppose, the people such departments are intended to help. (Check out whatcheer.net to see some.) Another way to say it is that they represent someone else. What's different about the 1936 drawing is that it seems to imply that the person who might need help is *you*.

[You can see the old logo, and some newer ones, below.]

Jacob Hacker, who teaches political science at Yale, wrote a book last year called "The Great Risk Shift." In it, he proposes that the most significant public policy changes over the past 30 years have been those that forced us all to assume more risk in our lives than our parents. Long-term employment contracts went out with the original VW bug; fixed-rate mortgages have been supplanted by floating rates; and pensions, when they exist at all, are no longer guaranteed income, but 401(k)s, where your pension depends on how astute an investor you were.

The truth is that we live in a more uncertain world than a generation ago and these days, many of us are in a position where a serious illness, an accident or untimely death, a layoff or a divorce could throw their family's finances into a tailspin. Maybe that's why bankruptcies are up 600% since 1980.

Hacker uses evidence from newspapers and survey data to make his case. I have another source. We've all heard about the people who have been on welfare for years. The Governor wants you to be mad at them, even though most of them are too young to drive. But what about all the others? These are people who need the program for a while, and then they're over their crisis, or their children grow more independent, and then they get off.

I spent a little time this week with the results of a five-year study headed by Mary Ann Bromley, a professor at Rhode Island College. That study interviewed 638 people receiving cash welfare benefits in 1998 and 1999, and then again a few years later, to see how they were doing. The results are interesting, and quite complicated, but the basic story is pretty clear. Five years after they were receiving welfare, 55% of the study participants were happily employed. Another 23% had been off welfare, but had been forced back on -- usually by the loss of a job or by a medical crisis.

With that in mind, I went back to the DHS annual welfare reports and did some figuring. There are fewer than 10,000 families on welfare now, and compared to around 400,000 households in the state, that seems like a small number. But according to the reports and my rough calculations, over the past decade or so, it seems that more than 60,000 families -- upwards of 160,000 adults and children -- have received cash welfare benefits from the state. We don't help much (the benefit amount hasn't been increased since 1989) but we spread the help wider than most people think.

Stand in the grocery store next time you're there, and look around. It's likely you'll see no one who is on welfare right this very moment, since only about one out of every 35 of us is receiving benefits. But if there are more than seven or eight customers, you will almost certainly see at least one person who has been on welfare at one point, and is now doing fine. These people live in the city and they live in the suburbs. They are your neighbors, and they might even be you. And that's the point.

So here's the real tragedy here. We have a social problem, which is the real increase in risk and uncertainty in most people's lives over the past 25 years. And we have a government that is in a position to allay the problem. Income supports, health care, pensions and child care are all services happily (and cheaply) provided by governments in dozens of other countries, in Europe and around the world. But the position of the people we've elected to run our various governments is that we can't learn from those countries, and that government can no longer even try to solve the problems that only it can solve. Is that how you want your state run? With a padlock on the door?

14:28 - 26 Dec 2007 [/y7/cols]

Tue, 18 Dec 2007

[Appeared last week in the Woonsocket Call, the Pawtucket Times and other fine RIMG papers.]

An interesting fall: One week we open a stylish new bridge, and the next week, one of the most important bridges in the state is found to be unsafe for anything as heavy as, say, a truck. The Department of Transportation says they can't afford to fix the I-95 bridge in Pawtucket any time soon. But it would be cheap to build in a slightly greater upslope on either side of the bridge. That way, you can gun your engine as you approach the bridge, and soar across the weakened span without having to worry about whether there is more rust or steel beneath your wheels. Detours are for sissies.

But wait a minute. It can't just be cost, because at the same time DOT says they can't do anything about the Pawtucket Bridge, they just finished a new bridge in Providence and they're about to begin construction on a replacement for the Sakonnet River Bridge. They have money for new construction, but not for repairs?

As usual, we're at the end of a tale that only makes sense when you begin at the beginning. So here it is: sometime back in the 1970's -- it's a little hard to be precise from the documents I've seen -- the Assembly and the Governor decided to borrow several million dollars, not for any specific project, but just to keep the rivers of federal highway money flowing down the corridors of the state house. The interstate highways were almost done, and who'd want to dam that torrent? That money required a state match, and, well, why not borrow to match it?

Of course borrowed money isn't free, and you do have to pay it back, with interest. They borrowed it anyway, and simply took the interest payments out of the maintenance budget, and no one was the wiser. This created a budget hole, but who would miss a year's worth of bridge-painting? Besides, it's more fun to ask for a bond issue to build a bunch of new stuff than it is to admit to the House Finance chair that you're over budget.

But the next year the budget hole was still there, and the additional debt service only made it deeper. Unfortunately, no one had the guts to say this was a problem, that year, or the next, or any year since. As long as DOT could keep borrowing and new roads keep getting built, then everyone was happy, even if the maintenance situation got worse each year. And now the detour signs in Pawtucket tell you how bad it is.

In fact, the debt problem is so bad that a few years ago, those debt payments were moved out of DOT's budget and into the Department of Administration. This was a meaningless accounting change, but again it avoided the shame of having to admit they were spending way beyond their means. This coming year, DOT will borrow about $40 million, just about the same amount they pay in debt service. Does it sound like using one credit card to pay the minimum balance on another? It is. Other states don't borrow like we do; they reserve borrowing for special big projects, not the routine stuff we use it for here.

This is a crazy way to run the state's finances, and I haven't even gotten to the hundreds of millions in off-books, no-referendum borrowing of the past three years and the resulting $49 million in additional debt payments this year. The cost of DOT borrowing is a major contributor to the disaster of our state budget, but the blame is shared so widely that no one wants to talk about it because who could they accuse?

Another legacy of these bad decisions is that we don't fix roads and bridges; we replace them, since you can get federal money for new construction, but not maintenance. The old Jamestown Bridge didn't have the capacity of the new bridge, but its replacement was dictated by department finances, as much as by anything else. They didn't have money to do anything else. The current DOT Chief Engineer has already spoken about "replacing" the Pawtucket bridge. The grand new I-boondoggle over the Providence River, which will cost us upwards of $610 million before it's done, was originally proposed as a $150 million alternative to $50 million in bridge repairs. (In what I'm sure is nothing more than an alarming coincidence, the Sakonnet River Bridge replacement project is now said to be a $144 million alternative to $70 million in repairs.)

As the experience of tens of thousands of drivers can already attest, the I-boondoggle will do just about nothing to improve traffic, but by the time we count all the debt service, we'll have spent around a billion dollars on it. That's about one entire year's worth of state income taxes, in case you're wondering. DOT doesn't want you to think of that when you're next stuck in traffic there, and that's why they've paid almost $200,000 to the Providence PR firm, Duffy and Shanley, whose job it is to make you think about the bridge's stylish design instead. And it is stylish, isn't it?

The Governor doesn't want you to think about wrong-headed billion-dollar spending decisions, either. He wants you to ignore those little details and blame the state budget crisis on welfare recipients and interpreters on the state payroll. Will we let him?

11:11 - 18 Dec 2007 [/y7/cols]

Mon, 10 Dec 2007

[Appeared last week in the Woonsocket Call, the Pawtucket Times, and other fine RIMG papers.]

Last week the state Public Utilities Commission (PUC) voted not to change its rules about gas and electric shutoffs if you don't pay your bill, and rules about getting it turned back on. The PUC had been considering a minimum payment required to get your electricity turned back on, as well as new rules about who could be represented by whom at shutoff hearings, but they decided against it.

In any discussion of utility shutoffs, there is a question lingering in the back of people's heads. It was all over mine, so I'll be the one to admit it: why should I care? If someone can't pay their bill, then how is that different from ordering food at a restaurant without money in your pocket?

Here's why: nobody means to go to Burger King and accidentally winds up in the Capital Grille. And there's no lease or mortgage on your table even if you do, so you can leave if you need to. We have a world where it's easy to get into trouble, but hard to get out. Someone can get sick or laid off, or the price of energy can just shoot through their roof. Fuel prices have shot up by a third since this time last year, and it shows up in utility bills.

Meanwhile, the condition of the real estate market has made it so that even if you realize you're in a too-expensive-to-heat house, there may not be anything you can do about it. You're behind on your heating bill, but selling your house at a depressed price will mean financial ruin. Sounds like an easy choice, right? Maybe that's why 29,970 people had their electricity or gas shut off during the first ten months of this year. That's a record, up 18% since one year ago.

State law protects the very poor, elderly and disabled from having their utilities shut off between November and April, but that only means a reprieve of a few months, and it still leaves a few thousand people in the lurch. As of November 16, National Grid reports that 2,814 gas customers and 1,309 electric customers had their service shut off.

When I hear numbers like these, I can't help but also notice that Exxon Mobil's profits are down to only $9.4 billion this past quarter, down from $10.5 billion a year before. In fact, oil companies are currently so profitable that stocks like Exxon are propping up the Dow Jones average, even while the other blue chip and bank stocks slide down and down. And then there's National Grid, the energy conglomerate that now provides most of our state's electricity and natural gas.

It's difficult to tell from their filings what National Grid earns from Rhode Island, but there is no mistaking that it is a very profitable enterprise. In the first six months of this year, their financial statements show they earned a profit of $1.2 billion on revenue of only $3.2 billion on their electric transmission business alone. (About $152 million of profit that was from US operations.) This is a huge profit margin in any business, and is up 17% since last year.

A part of your electric rate is dedicated to bills that will likely never be paid off. According to the PUC attorney, this is about 1% of your electric bill, which covers a substantial part of the losses. But why this should come out of your bill at all is something that has never been adequately explained to me. This is, of course, the way things work with regulated private utilities, so what can you do?

As it happens, our state contains its very own counter-example. The Pascoag Utility District provides power to about 5,000 residents of Burrillville, and is owned by those very same residents. Pascoag isn't a particularly poor place, but like all our towns, they have some poor people. And no town is immune from illness, divorce and layoffs. But as of November 16, they had zero ratepayers cut off for non-payment of their bill. Plus their rates are lower. (Or they will be after National Grid's proposed 5% rate hike in January.)

I asked Judy Allaire, their deputy general manager about all this, and she told me there were plenty who were cut off over the summer, but that they were mostly people who had fallen into some temporary bad situation and that they'd worked out payment plans with each of them. She told me, "We're smaller, so we know our customers and we know when they're getting into trouble and can help them get out." Pascoag can do things that National Grid can't, partly because they're smaller, and partly just because there are no shareholders demanding their investment returns.

Decades ago, our nation decided that regulating private utilities was better than trying to own and run them. Over the years, this has created these strange situations where you have public bodies like the PUC guaranteeing the profits of private investors. The system does appear to work, after a fashion -- people get their electricity and the investors get their profits -- but right here in Rhode Island, next to the huge for-profit utility is a little municipally-owned enterprise that gives better service for less money. Markets are fine things, but we shouldn't let them blind us to other possibilities for organizing government services. Like health insurance, for example. For most of the knotty policy problems facing us and our government, open minds are what we need to get the job done.

21:57 - 10 Dec 2007 [/y7/cols]

Tue, 04 Dec 2007

[Appeared last week in the Woonsocket Call and Pawtucket Times and other fine RIMG papers.]

All the leaves are brown and the sky is grey, and I have Governor Carcieri's staff reduction plans to evaluate. We finally learned last week that the Governor's proposed job cuts will not all be in invisible "back office" positions. It turns out that he's not only talking about middle managers, but about front-line state employees: translators, janitors, cooks, nurses, social workers and many more.

As you look over the list, you do get the feeling that many of these jobs are, indeed, overdue for reconsideration. Why, for example, does the taxation division need both a Director and an Executive Administrator? The Director is on the chopping block, and perhaps that's just as well.

On the other hand, reading the list also tells you that the $41 million in savings the Governor is claiming simply won't happen. I see several lawyers in Human Services (DHS) who are due to be cut. Will anyone bet against me that those salaries won't be replaced by payments to $300-an-hour law firms? We've also heard about the Cambodian, Hmong and Portuguese translators to be laid off from DHS. But Hmong speakers are still going to come to DHS for help, and someone is going to have to translate for them. The Governor's proposal is to rely on those people's children, but it's hard to imagine that no money will be spent on translation services.

On the list I also see what seems like the entire kitchen staff at Zambarano and Eleanor Slater Hospitals. Oddly, this sounds just like the (unsuccessful) proposal he made earlier this year to privatize those services. You may think this is a good idea, or you may not, but either way, you have to be skeptical of anyone who claimed all their salaries as savings. Does the Governor imagine that some private contractor will cook for the state's patients for free? If he does, it might explain why he's so enthusiastic about privatizing services. I hope someone breaks it to him gently.

The truth is that privatizing is not a sure-fire way to cut costs. Contractors are sometimes cheaper than state employees, but not always, and there are frequently significant costs to contracting that never get counted. DHS is on the hook for about $5 million a year to Northrop Grumman these days because years ago the department made a choice to rely on contractors to maintain the computer system that pays state welfare checks. The system was written in an obscure database language, and Northrop now has most of the remaining experts in that language on their staff, so we are stuck with them until we ditch the whole thing. Had we made a different decision back then, we'd be paying far less to maintain the system today.

There are other problems, too. Rising pension payments are one of the real problems in state and local budgets. Several hundred fewer people paying into the system isn't going to make it cheaper for those who remain. And we haven't even gotten to the bumping and seniority issues. We are facing a $400 million deficit next year, and the Governor offers us a $41 million cut that is really just a fraction of that. He says he'll make it add to $100 million with cuts in employee benefits, but so far it seem like just budgetary dreamin'.

Where will the balance come from? Not taxes, or so says Carcieri. In speeches and interviews lately, he's been making much of "those who would raise your taxes." But who are these unnamed people? The Poverty Institute, not exactly a power center, but probably the most prominent statewide advocacy group for social services, is this year only proposing rolling back a couple of the tax cuts granted over the last few years. I've heard no member of the General Assembly speak in favor of raising taxes, and to the amazement of those with fingers to count on, the Assembly leadership remains committed -- at least in public -- to cutting taxes on the rich even more. As I've written before, I happen to think it would be a dandy idea to address some of the injustices perpetrated by the last few years of tax cuts for the rich and tax hikes for everyone else, so maybe he means me.

If so, it's kind of flattering, really, but who knew responsibility could be so lonely? The crazy thing about the state budget crisis these days is that it sometimes seems like there is no one on the side of paying for state services with, you know, revenues. Once upon a time, this was thought to be a hallmark of serious discussion about government, but in our modern tax-cut-happy world, that kind of talk is simply not the done thing.

The Governor is right about one thing: There really is a dark and malignant force moving stealthily across the political landscape this year. A spectre is haunting Rhode Island -- the spectre of arithmetic. Eventually, he and the Assembly are going to have to make things add up. Let's all hope for a bit less dreaming when that day comes.

15:05 - 04 Dec 2007 [/y7/cols]

Mon, 26 Nov 2007

What you didn't know about welfare.

[From the Woonsocket Call and Pawtucket Times, etc.]

The Governor made it clear last week that he wants to include discussions about welfare in the debates over the state budget crisis, again. Fair enough, I suppose. No budget item is sacred. But let's make sure we know the facts first.

How much don't you know about welfare? Like many people you might have heard that Rhode Island is a "welfare magnet," attracting welfare recipients from other states by our lax rules. Did you know that the actual data show exactly the opposite?

Did you also know that the cash benefits to welfare recipients haven't gone up since 1989? How about that about a third of welfare recipients leave the program each year for work? Or that by every measure, the cost of the program has gone down dramatically since 1997, though the savings have been put into child care and other non-cash benefits. In other words, the Department of Human Services' annual report about the "Family Independence Program" (FIP) is a fascinating read, mostly for the contrast between what it shows and what is widely believed. (Don't take my word for it; it's readily available at www.dhs.ri.gov.)

I read the report this morning, and learned that in 1996, 1225 families joined the program when they moved here from other states. In 2006, the number was 721. These data are self-reported, on the welfare application, so perhaps are not terribly reliable. However, there are three reasons to believe them. First, there are no penalties either way, so there is no incentive to lie on the application. Second, the data was collected precisely the same way in 1996 as in 2006. Third, there are no other data on the subject.

What's more, since 2001, more welfare recipients have moved away from Rhode Island each year than new ones arrived. Despite this, you hear this "welfare magnet" thing all the time, on the editorial pages of newspapers, on talk radio, and in speeches by politicians, including Governor Carcieri (an example). But it's not just that the balance of facts don't support it; no facts support it. When I asked him the source of his assertion when he cited the cost of our kindness in a column, Ed Achorn, the Providence Journal columnist, told me only, "I am citing common sense there." But I know of no definition of common sense that implies I'm supposed to believe things uninformed people made up just because they assume them to be true.

Besides, we're not even all that kind. This part of the welfare magnet fiction is only empty self-congratulation. Welfare benefits here are skimpy and the rules restrictive, just like in other states. Even with the non-cash benefits like food stamps and rent vouchers, this is not a program you can use to support a family for long -- and people don't.

In December 2006, there were 10,755 families on welfare (down from 19,000 in 1997) but this is only an end-of-year snapshot. During the year, there were 6,885 families that joined the program and about 7,855 left it. A bit under half of them left because they got a job. The others moved, or were cut off. Also, notice that there were a thousand fewer people getting assistance in 2006 than at the same time in 2005, and this was before the latest round of "welfare reform", enacted last year with the 2007 budget.

As we look forward once again to balancing the budget by denying help to our friends, neighbors and relatives who need it, let's remember the purpose of welfare: it's to help people with children out of a bad situation. It's a program for temporary assistance, and the evidence shows that people use it temporarily. Remember, three quarters of the people who were receiving welfare in December 2005 stopped getting it in the next twelve months.

Here's another widely ignored fact, worth remembering in a week of Thanksgiving. Even for people in the middle of some family crisis, welfare is a choice. This means there's a limit to how restrictive you can make the program if you truly want it to be useful. No one is forced to apply for welfare benefits. That is, you can always eat dog food. And it's fairly dry under most of our bridges. Or you could just decide to stay with the abusive husband. The point of having a program like FIP is to prevent parents and children from having to face situations like these. If the program doesn't prevent that, then what's the point of even pretending to help?

23:08 - 26 Nov 2007 [/y7/cols]

Sat, 17 Nov 2007

Getting serious about state spending

[Appeared first in the Woonsocket Call, Pawtucket Times, etc.]

When you talk with people for any length about the state budget, unions are bound to come up. When you talk with people for any length about unions in the state, the Brotherhood of Corrections Officers is bound to come up.

In many ways,the Brotherhood is among the more militant of the state's public employee unions. Plus, a crowd of prison guards is just a teensy bit more imposing than a crowd of teachers, so they get press. They have been in the news over the last few years for helping prevent the establishment of halfway houses in Rhode Island and for contracted work rules that force the extensive use of overtime at the state prisons. As a result, few people find it surprising that, after accounting for inflation, we spend 160% more on the state prisons now than we did 20 years ago.

But what might be a surprise is that 160% is just about the increase we've seen in the number of inmates since then: from 1528 in 1988 to 3937 in September, about 95% of capacity. The number of people on probation and parole is up 170%, from 10,000 to 27,000. That is, after inflation, we spend about the same per prisoner now as we did 20 years ago. The real problem is that we have a lot more prisoners.

Why are there so many more? It's largely because in 1988, we passed legislation establishing a mandatory minimum sentence of 10 years for people convicted of possession of as little as one ounce of heroin or cocaine. That year we also amended the state constitution to deny bail for drug offenses where the potential sentence was 10 years or more. Not surprisingly, the prison populations shot up, fast. In 1988, we had 87 women in our prisons, and one year later there were 215.

But it sounds tough on crime, right? Well crime did go down in the 1990's, across the nation, and part of the reason was that lots of criminals were in prison. But it's a pretty expensive strategy for fighting crime. We could get a lot more bang for the buck by using that money to hire more police officers. We have expanded our police departments, but the towns who can afford to do it tend not to be where the crime is, so Glocester has three new police officers since 2000 while Woonsocket has only one.

Drug treatment programs would be another way to save money. It costs less to help someone get over a drug habit than it does to put him or her in prison. But there's "no money" for that, of course, and what few programs we do have in the state can handle only a tiny fraction of the demand. There's more: our probation system is huge and contains some serious injustices that fill up our prisons. Around 40% of our inmate population is probation violators.

So this is the way it works: You could try to blame the Brotherhood for the high cost of our prisons if you want to, and people do that all the time. But what the data shows is that the most you can blame them for is not letting us cut the cost of our prisons. There most certainly are work rules that should be addressed and the Brotherhood's definition of who is supervising prisoners is more restrictive than one I'd suggest, but the truth is that over the past 20 years, for all their strength, they have only been able to hold the line. As usual, the people who spend all their time blaming unions for our budget woes are just trying to distract you from the expensive decisions that have been made.

Some of these decisions were made a long time ago, but most have been endorsed recently. Last spring, the legislature repealed the 1988 mandatory minimum drug laws. The Governor vetoed the repeal, so the minimums remain on the books. The Assembly met a couple of weeks ago to override a bunch of vetoes, but this wasn't one of them.

And how about that I-way? Here's a hugely expensive project that gave us a new-and-improved bridge but only minor modifications to the capacity of our two biggest roads. Now that the first bit of it has opened, we've all enjoyed a week's worth of new-and-improved traffic jams. Projections are that the project will cost well over $700 million, and probably much more by the time it is done and its bonds are paid off. It was originally proposed as a more fiscally prudent choice than $50 million to repair the existing bridge over the Providence River. The Department of Transportation has some serious issues with the union work rules it has established over the years, but they are small beer compared to the mighty I-boondoggle.

So here's an easy way to tell whether people are serious about addressing the spending side of the state's budget crisis. If they want to talk about the expensive policy decisions we've made over the past twenty years, and also want to talk about contracted work rules or seniority provisions, then humor them. They might have a good list of suggestions. But if they tell you that unions are the big problem, they aren't serious. It's just that simple.

23:21 - 17 Nov 2007 [/y7/cols]

Sun, 11 Nov 2007

Taxes are taxes, until you ask who pays them.

[Appeared last week in the Woonsocket Call, Pawtucket Times and other RIMG papers.]

Are taxes just taxes? Does it matter when the state cuts the income tax and towns raise the property tax? As a matter of fact it makes a world of difference, and here's why: Like the federal income tax, the Rhode Island income tax rate gets higher as you earn more income. People who earn very little pay a very small fraction of their income in tax, while people who earn a lot pay a greater fraction. In Rhode Island now, the Greens who earn $50,000 a year will pay about 2% of their income in tax. The Browns earn around $200,000, so pay tax at around 7% most years.

But though one family earns four times as much as the other, they probably don't live in a house four times as expensive. The Greens might live in a house assessed for $250,000, and the Browns in one that's worth $500,000. The Browns have four times as much money as the Greens, but pay only twice as much in property tax. But their bill reflects the value of their property, so fair enough, maybe.

Now let's change things. Say we cut income taxes by half, and make up the difference by raising property taxes by a third, which is very roughly the same amount of money in the real Rhode Island. From the income tax cut, the Greens get $500 back and the Browns get $7,000. But the property tax rates in their town go up, from $12 to $16. The Greens get hit for $1000, and the Browns for $2000. The result is that the Browns are richer by $5000 and the Greens poorer by $500. Meanwhile, the total collected from the two taxes hasn't changed at all. The only difference is who pays.

Over the past dozen years, our state has done exactly that. We've cut the income tax several times, in a few different ways. At the same time, the state (and federal government, too, but to a smaller extent) has piled responsibilities onto our cities and towns. Special education requirements, ADA requirements, transportation to private schools, textbooks for private schools, curriculum requirements, testing requirements and fire code requirements are all recent additions to an already long list. After all that, it's no surprise that municipal budgets have gone up 6% a year since 1996, before accounting for inflation. Outrageous, no?

But over that same period, the state budget (not counting the money given to cities and towns) has gone up 6.8% a year. The take from the state sales tax has gone up 6.7% a year and -- despite several tax cuts -- the money we collect from the state income tax has grown 7.1% a year over that period. Meanwhile, total property tax collections have only grown 4.4% per year. In 1996, the income tax raised about half of the property tax. Today it's about 60%. The income tax is bringing in much more money, with a lower rate, while the property tax rates have gone up and up over that time. The state gets credit for cutting taxes, while the cities and towns have had to suck it up and endure lectures from the Assembly leaders and Governors about fiscal responsibility, not to mention the occasional tax riot.

Does it surprise you that property taxes play a smaller part in the picture than they did ten years ago? For eight out of ten of you reading this, it might. That's because you're the ones paying higher taxes to finance cuts for the other two.

So this is the situation: Governor Carcieri and the Assembly leadership won't say what services are to be cut, but both insist that lower taxes are possible. On what evidence they think this, they won't say. Along with the tax cuts from last year and the year before, we're on schedule to give another $12 million cut to the wealthiest citizens in our state this year, and tens of millions more in the following three years.

To get there, the Governor thinks he can slash a bit here and there in contractors and "back office" positions, and from employee benefits, and the state can keep on merrily building bridges and jailing prisoners like before, and no one will notice. On their side, the Assembly leadership thinks it can stiff the cities and towns, who will keep on merrily educating our children and policing our streets like before, and no one will notice.

They are both doing the same thing: pretending that we can have lower taxes for the same services, year after year. The Governor does it by pretending his Sweeney Todd "trim" of only a couple hundred million dollars won't make a difference, and the leadership does it by forcing town councils and school committees to make the real decisions. I am happy to know that people in positions of such heavy responsibility can enjoy such rich fantasy lives, but I'd be happier still if I didn't have to beg my school committee not to cut the music program each year.

22:31 - 11 Nov 2007 [/y7/cols]

Wed, 07 Nov 2007

The state budget: choosing a crisis

[Appeared last week in the Woonsocket Call, Pawtucket Times, etc.]

In 2006, when the legislature passed its tax cap for rich people (also known as the alternative ``flat'' tax), they did it without saying what services would be cut to pay for it. The way the tax cut game is usually played, the cut has to be phased in over several years, leaving. the harsh spending decisions to some future legislature. Naturally we're all supposed to pretend not to notice how cowardly it is to propose a tax cut without saying what will be sacrificed to pay for it. Are you in favor of lower taxes? Put that way, who isn't? Where it becomes hard is after we understand what we're giving up.

In this case, the phase-in strategy is especially nasty because the cuts get successively more severe each year. The way the cut works is this: taxpayers can choose between using the tax tables you and I use to calculate our taxes, or using a flat percentage of taxable income. Because of the way our income tax is structured, only the richest taxpayers will save any money by choosing the flat tax. Starting in 2006, the tax limit ratchets down by half a percentage point each year, until it rests at 5.5% in 2011. As of this coming year, the limit is 7%, so it affects married taxpayers earning more than around $260,000 per year.

Another exciting feature of this cut is that it was made on the basis of false estimates of how much it would cost. The Tax Division declined to provide projections about the cost in future years. Instead, they provided an analysis of 2005 income tax data that showed what the cut would have cost in that year. This is not the same thing, but it's all they could be persuaded to do. By their count, when fully phased in, the cut would have been worth $73.1 million, in 2005.

But incomes grow over time, and at this point in 21st-century America, the evidence mostly shows that incomes at the top end are growing faster than incomes at the bottom. In other words, this number can't possibly be a good estimate of how much the flat tax cut will cost. Unfortunately, because there were no other numbers available, legislators and advocates seized on these, and in speeches and in discussions, you'd hear them speak as if this were the true cost.

Projections aren't that hard, though like any prediction of the future, you have to remember to be humble. Using income growth statistics and past tax data to simulate half a million taxpayers like ours, I wrote a computer program to fill out an imaginary tax form for each of them. This used to be the kind of number-crunching that could only be done by government researchers and others who could command lots of computer horsepower. But one of the great things about the march of technology is that any computer with enough oomph to run World of Warcraft has the speed to fill out a measly few hundred thousand tax forms, and I only played a couple of Freecell games before it was done crunching through them all. It gave good results for past years, so then I asked about the future. The predictions that burped out showed the tax cut will cost $27 million in fiscal 2009, an increase of about $12 million from this year. But in 2012, when it's fully phased in, it will cost around $110 million. This is a lot of money to be giving back to rich people in a state where no music teacher is safe.

This year, you're going to hear a lot of people say we shouldn't raise taxes to balance the state budget. Those people are trying to mislead you by ignoring the fact that the biggest reason our state budget isn't in balance is the huge tax cuts we've given and are still giving. If we were to magically transform the income tax back to the rates of the bad old days of 1996 -- reversing the 1996 capital gains cuts, the 1997 Almond income tax cuts, the 2001 capital gains cuts and the 2006 flat-tax cuts -- we'd be collecting over $200 million more than we are expecting next year, and that's only the cuts in the income tax. By itself, restoring these cuts wouldn't be a particularly good idea, since property taxes have shot up to take the place of the lost revenue, but it gives you a good idea about how we got into this mess: we chose it. It was the completely predictable result of conscious policy decisions made by people in charge. Ten years ago, I asked Michael O'Keefe, then as now the guy in charge of fiscal advice to the House Finance Committee, how on earth he thought we could afford the tax cuts the committee was about to pass. His reply: "The Chairman [then-rep. Tony Pires] feels that the state would benefit from increased fiscal constraints in future years." Well here we are.

I know what you're thinking: taxes are taxes and it's a darn good thing we did cut them. But there are very important differences between income taxes and property taxes that won't fit in the rest of this column, so I'm going save that for next week. In the meantime, consider this: Maybe you think these cuts are all necessary. Maybe you don't. Either way, does that mean we should pretend they didn't happen?

06:46 - 07 Nov 2007 [/y7/cols]

Sun, 28 Oct 2007

Our flinty neighbors to the north.

[Appeared in Woonsocket Call, Pawtucket Times, etc, last week.]

After a column I wrote about taxes, a reader wrote in to ask about New Hampshire. He wrote that they have half the number of state employees there, and still manage to pave their roads, and do it with no income tax and no sales tax. When you write about taxes and state budgets in Rhode Island, you hear a lot about New Hampshire, a fact that amused several of the New Hampshire officials I spoke to. It seems they don't spend much time thinking about us.

But let's clear up some misconceptions about our flinty neighbors to the north. New Hampshire has no income tax, right? Well, sort of. They have no income tax on wages, but they do tax unearned income, like interest and dividends, at 5%. A married couple here have to be making well over $100,000 a year before they're taxed at that rate. New Hampshire has a business income tax of 8.5% to 9.25%, depending on size and they define taxable businesses much more liberally than we do, with three times as many business tax returns filed than here. The business income tax funds a quarter of their budget and 4% of ours. If I, a self-employed writer, were to move to New Hampshire, my state taxes could go up.

What about the property tax? They have lots of towns, and some tax high and some are low. But it's quite easy to find New Hampshire towns where the tax rate is much higher than in any town here. (Try it yourself: NH, RI.) Most of those are the places where the residents outnumber the tourists. Like several of our seashore towns, a lot of New Hampshire belongs to out-of-state owners. When out-of-towners are paying the bills, taxes can be lower, because people whose real homes are elsewhere also educate their children elsewhere, and they don't call the police in the off-season either. We see the effect here, too, which is why Block Island, and Little Compton have low tax rates. So Franconia and Jackson, up in the mountains, have very low rates, while Keene and Jaffrey, in the unfashionable parts of the south, have rates double or triple those.

According to the 2002 census of state and local governments, New Hampshire and its counties and towns raised about $5.1 billion in taxes, while Rhode Island and its towns raised about $4.8 billion. We divided our taxes among about a million people, and they among 1.25 million. So, per person, their taxes work out to about 89% of ours: New Hampshire may be a low-tax state, but it's sure not a no-tax state, which is the image that many people around here seem to have.

Still, 11% lower taxes isn't anything to sneeze at. How do they do it? Mostly, it turns out, by simply not providing things we take for granted here. We have a state Education Department and so do they, but ours gathers data about all the state's school districts and helps plan and suggest curriculum and professional development programs for their towns and theirs does not. We have a Health Department and so do they, but ours is responsible for food inspection and public health issues, and theirs is not. We have town libraries and so do they, but ours participate in a statewide network, with a shared catalog and reciprocal borrowing privileges coordinated by the state, and theirs do not. There are plenty more.

Another big difference is clear when you look into the facts. New Hampshire's social spending is lower in large part because it's a richer state; income is higher and the poverty rate is about half what it is here. Some will say that's because of their low taxes and pro-business "climate". But urban poverty has been a source of trouble for decades, and even back when the two states had roughly equal average incomes, poverty was much higher here, because we've got cities, and they don't. (Manchester, their biggest city, is just a bit bigger than Warwick.) In 1980, the poverty rate was 10.7% here and only 7% there, but the per capita incomes were both about $9,200. We had more poor people, but apparently we had more rich people, too.

So why are the states so different? Why one place grows to regard as normal what another place thinks of as extreme is one of those mysteries that make our world a fascinating place, but there are some obvious differences in geography that seem relevant. Both New Hampshire and Rhode Island abut a state whose economy, driven by its universities, has been one of the more remarkable success stories of the last few decades. But New Hampshire's border with Massachusetts was mostly wide-open rural areas ready to become suburban developments (for better or worse) while much of Rhode Island's border was occupied by cities. As the interstate highways allowed people to flee cities over the past 40 years, New Hampshire gained and Rhode Island lost, for no reason other than geography. I-93 brought people to rural New Hampshire and I-95 took people from Providence.

Heaven knows we don't run our state government very efficiently. Sometimes comparisons with other states can be revealing, but more often what they show is the limitations of such comparisons. New Hampshire is a very different place than Rhode Island. To their credit, they've been able to capitalize on their advantages to prosper over the past two decades. I wish we could agree to capitalize on our own advantages, rather than just wish we had theirs.

20:38 - 28 Oct 2007 [/y7/cols]

Fri, 26 Oct 2007

[Appeared in the Woonsocket Call, the Pawtucket Times, and others.]

We learned last week that Operation Dollar Bill, the federal investigation of the Senate leadership, involves tax legislation. In federal court, Gerard Martineau, the former Senate Majority Leader from Woonsocket, admitted to crimes involving taking money from CVS in exchange for legislative favors. In cases involving other former Senators, we've already heard about corruption involving "pharmacy choice" legislation, where the legislature rejected bills that would have allowed pharmacies to compete with each other for your business. But now we hear that some of the favors may have involved the 2002 capital gains tax cut. If it's true that money changed hands in order to influence tax legislation, I have some free advice for the CVS and Blue Cross executives who gave it: Don't waste your money. Most of the legislators in our General Assembly love you already, and money can't buy that kind of love.

Here's the background. In the 1990's, Massachusetts eliminated its tax on long-term capital gains, the money you earn from the sale of some asset, like stocks or a business, so long as it was held for more than six years. And in 2000, the drum began to beat here for a change to "compete" with Massachusetts. Martineau was an enthusiastic drum-beater, doing as much as anyone to speed this along.

In 2002, the General Assembly eliminated the tax on long-term gains, though the first step didn't go into effect until this year. (And because of the budget crisis this past spring, the legislature delayed the second step.) Putting cuts off into the future is, of course, the usual way faint-hearted legislators avoid questions about what services will be eliminated to pay for them. But while eager investors waited for the cut to take effect, what happened in Massachusetts? Well, they had their own budget crisis in 2002, so they reinstated the capital gains tax, acknowledging that cutting it was not affordable.

You'd think that we could have used that excuse to put off our cut, but no. After all, love is an ever-fixed mark that looks on tempests and is never shaken, or so I've heard, and legislators remain in love. They appear locked into the view that investors drive the economy and making things nice for investors will make the economy better for all the rest of us. But where's the evidence for that? Investors who start or grow businesses are valuable, but they're only a part of the puzzle, along with inventors, workers and customers. Sacrificing the interests of these other groups to favor investors is what we're doing.

What's worse, most investors aren't even investing in local businesses. The Federal Reserve publishes statistics about this, and the September report (the "Flow of Funds", or "Z.1" report) has interesting things to say on the point. Nationally, about 10% of our assets are in non-corporate businesses and 20% in stocks and bonds. A generation ago, in 1974, 20% of our assets were businesses and only 14% in stocks and bonds. As the profitability of small businesses has declined, our taste for investments has changed, and investors today are much more likely to be speculating in the stock market or in real estate than they are to be growing businesses here at home.

Stocks and bonds are traded much more often, too. Again according to the Fed, we sold around ten times as much in stocks as in business shares so far this year. This means that for every person getting a tax break on the sale of some business they built, ten people are getting a tax break on some stock they bought. And who are these people? According to IRS statistics, in 2005, Rhode Islanders reported about $1.7 billion in capital gains income. About $1.3 billion of that was reported by people who earned more than $200,000 that year, a fifth of that group's income.

Every small business owner I've talked to in the past few years has told me the same story about how their business started: The money to start was scraped together through savings and from family and close friends. These people will eventually sell their businesses in order to retire or move on, and they may be wealthy when they do. Perhaps it would be nice to reward them for their hard work at that point, but wouldn't it be nicer to make their businesses more profitable before then? We could invest in our schools in order to make it easier for them to find good employees. We could create a health-care system that takes health insurance out of the picture for employers. Some will perceive this as a two-edged sword, but we could work to create more and better customers for businesses by raising the wages of our lowest-paid workers, which seriously lag Connecticut and Massachusetts. There are dozens of things we could try, if we had the imagination to try them. The capital gains tax cuts will only prevent us from trying them.

Many of our legislators own small businesses themselves. (Gerard Martineau among them -- it was purchases of bags from his company that CVS used to finance his legislative career.) Most of them know how businesses really get their start, but rather than think about the real problems faced by real businesses, our legislative leadership thinks that the route to prosperity is simply to roll out the red carpet to all rich people, and hope that some of them feel charitable toward the state they call home. This is love run amok, and more resembles a strategy for finding a bad marriage than a strategy for developing our state's economy. It's long past time we wised up.

11:07 - 26 Oct 2007 [/y7/cols]

Tue, 23 Oct 2007

State Pensions: Who is the liability?

[Appeared in the Woonsocket Call, the Pawtucket Times, and others, two weeks ago.]

The Governor has announced his plans to cut 1,000 state employees and to cut $50 million state spending and another $50 million in benefit costs for the remaining state employees. I can say stuff like that, too. Watch: I will cut all 15,353 state employees! Except the lifeguards at Scarborough. Of course I'm not the Governor, so it's a tiny bit less credible, but not by much. Until he starts to say what positions he will cut, from which departments, and which services will be sacrificed to make this plan work, it's all just words, about as valuable as mine. (Not to mention how he will overcome such obstacles as employee statutory status.)

While we all wait for the Governor actually to make one of those tough decisions he's always talking about, here's something to consider: he is proposing cutting employee benefits, including pensions, for state employees. William Murphy, the Speaker of the House, is proposing a shift in the kind of pensions we offer to state employees. (Which will actually cost *more* in the short term.) What neither of them will say is that we could lower pension costs for the state, as well as for all the schools, by about $43 million or more without reducing benefits or paying another dime. All it would take would be a signature, but Governor Carcieri won't consider it.

The story isn't too complicated, but there are four important things to understand about it. First, and this will come as a surprise to many, current state employees and teachers pay almost all of the cost of their own pensions. State employees pay 8.75% of their salaries and teachers pay 9.5% into their pension funds. This current year the employer (the state and the schools) only pay about 1.5% of payroll to match what are called the "normal costs," which are the expected costs of paying the pensions of the employees who are in the system now.

Second, the system has a big "unfunded liability," which is the difference between what the system expects to have and what it expects to pay, in the future. Paying this off is where the real expense is, and the state and schools are paying about 20% of payroll for that. For a long time, state pensions were underfunded. We gave legislators, judges and other favored employees pension credit for time in the military, for time in other pension systems, and sometimes just for having a nice smile. These abuses have been largely (though probably not completely) eliminated, but their legacy lingers on in the unfunded liability. What's more, for a couple of years after the credit union crisis of the early 1990's, the state skipped its payments entirely. And some predictions about investment returns, or the death rates of retirees turned out to be wrong. (Actuaries aren't soothsayers, and they do get things wrong, but they tend to be high some years and low other years, so it's likely that poor predictions aren't the real problem.)

Third, in 1999, the state began a program to pay down the unfunded liability. This is a good thing to do, but it's important to understand why it's a good thing to do. For private businesses, getting the unfunded liability down to zero is important because businesses can go out of business, and you want the pension system to be able to survive that. The state isn't going to go out of business, but keeping the unfunded liability small helps reduce "volatility" in future pension payments. This is actuary-speak for sudden cost increases. So, doing the responsible thing, in 1999, the state decided to pay off the unfunded liability in 30 years, by 2029.

Fourth, no sooner had the state decided to pay down the liability than the stock market tanked. So for the first five years, the extra payments weren't enough to make up for the investment losses. They have by now, but we're still on track to pay off the liability by 2029. Except now instead of a 30-year payment schedule, we have a 22-year schedule, and the payments are higher, just like a mortgage would be. If we restarted the clock, and moved the payoff date to 2037, state payments would drop by $28 million and the cities and towns would save $15 million. Ask your local school principal if that would be a good idea.

Sounds radical, no? Well, there are radicals in North Dakota, Iowa and Kentucky who do this *every year* for retirement systems there. Oklahoma, too, and they use a 40-year schedule. Actuaries call this an "open" amortization schedule, and it's not at all uncommon. You don't get to a date certain for paying off the liability, but you do make progress on it every year, and that's what being prudent means.

What being prudent doesn't mean is to break the system in the present so that taxpayers in the future will have it easier, which is what we're doing now. I guess there's a certain nobility in suffering now so that our children won't suffer in the future, but our children also attend the schools where pension costs are displacing spending on books.

So as you read the moaning about the state deficit this year -- and there's going to be a lot of it -- remember that a simple fix like adjusting the pension payment schedule is considered off the table. And also remember that, counting the capital gains cuts and the tax rate cap, we're going to give somewhere around $50-60 million in income tax breaks to our wealthiest citizens. Now go read those headlines about cutting state services again and see what you think.

07:28 - 23 Oct 2007 [/y7/cols]

Sat, 20 Oct 2007

A solution in search of a problem

[Column originally appeared in Woonsocket Call, Pawtucket Times, etc.]

Last spring, Ralph Mollis, our new Secretary of State, announced the formation of his "Voters First" commission. The idea was to find ways to improve how we vote. Some of his proposals -- extending elections to cover several days and eliminating the need for an excuse to get an absentee ballot -- aren't bad. My favorite is about improving the training and pay for poll workers. Many of them are hard working and intelligent volunteers we should honor, but they are often not informed about the details of election laws. I've twice been threatened with arrest for seeking public information from poll workers on election day.

One proposal, however, stands out from the others: requiring a photo ID to vote. In conversations with friends, I've often heard people express surprise that you don't need an ID to vote, but you do need one to cash a check. To me, though, it always made the process seem more serious and adult. "We trust you," those little forms seem to say, "but heaven help you if you're trying to pull a fast one here." That is, you may need less ID to vote than to cash a check, but the penalties are much more severe.

There are two real problems with the proposal. The first is that requiring an ID is actually a significant burden to a surprising number of people. If you have a photo ID, reach into your pocket or bag and pull it out. Does it have your middle initial on it? Does it have your maiden name? Is it written exactly the same as the way you registered to vote? Does it have the right address? If not, be prepared to be turned away from the polls.

For people who can't afford a car, or who don't drive for other reasons, getting a photo ID can be a significant burden, financial and logistical. Getting the necessary paperwork isn't cheap; a birth certificate can cost beteween $20 and $75, and naturalization paperwork can cost $200 or more. And that's assuming the voter ID is free. Your driver's license isn't.

Timothy Vercellotti and David Anderson, two researchers at the Eagleton Institute of Politics at Rutgers University spent some time last year comparing the detailed 2004 election results across the country with census data, and comparing non-photo-ID states to photo-ID states, district by district. They concluded that voter ID laws had the effect of lowering voter turnout by between three and four percent, and by 10% or more in minority communities. (You can find a link to the report at whatcheer.net.) Like much social science, the research simply confirmed what many people already knew. Are voter ID laws a good idea? It depends on what you think about discouraging poor and minority voters.

Sad to say, some people think that's a good idea, and they are usually the ones you'll find behind proposals like this. Photo ID requirements for voting are a part of an increasingly sophisticated set of techniques used to suppress voter turnout by people who believe that suppressing voter turnout favors them. This is usually Republicans, which is why photo ID laws have been passed in states like Georgia, Missouri, Arizona and Indiana, where the Republican party dominates state government. Hawaii, where Democrats are in control, stands as a single counter-example, and I suppose with Mollis's leadership, we could add Rhode Island to the list, too.

The other big problem with photo ID laws is that this is really a cure without a disease. This is Rhode Island after all, and after every state election since I've been an adult, I've heard rumblings about vote fraud. I've heard allegations of candidates and campaign staff trolling nursing homes and senior high-rises for seniors who may need "help" filling out absentee ballots, and I've heard allegations of manipulation of the old black voting machines we used to use. I've heard allegations about machines mysteriously refusing to advance their counts, and I've heard allegations about people maintaining false addresses in order to vote (and run) in the wrong district. I've heard lots of allegations, and I even believe some of them, but I've *never* heard an allegation of fraud that would have been prevented by requiring a photo ID.

What would a photo ID requirement prevent? Well, it would prevent a candidate from recruiting people to run around from poll to poll, impersonating other voters in order to vote multiple times. Do you believe that's been happening in your town? It would take a few dozen to make any difference. That's a lot of people willing to risk a jail term, and it's a lot of people to keep a secret. As Ben Franklin put it, three can keep a secret if two are dead, so color me skeptical that this kind of fraud is a problem.

Last week, the US Supreme Court has agreed to hear an Indiana case on the subject this winter, and will issue a ruling by next June. Will the conservative majority on the court forbid an important Republican election tactic? Color me skeptical on that, too.

The Secretary of State is still soliciting opinions about this proposed rule, which will probably become a bill in next year's legislature. There's an email link on the Secretary of State web site: www.sec.state.ri.us. Tell him what you think.

19:22 - 20 Oct 2007 [/y7/cols]

Mon, 01 Oct 2007

Are state taxes your biggest problem?

[Appeared last week in RIMG papers all over Rhode Island. If this wasn't in your local paper, complain to the editor.]

It's hardly news to anyone that the state is in a terrible fiscal situation this year. It will be very surprising if we end this fiscal year without a deficit, and the deficit anticipated in *next* year's budget looks immense. Numbers north of $400 million are being discussed around the state house. For some perspective, this is over 10% of the state's entire budget.

The Governor spent a little time last week trying to prepare the ground for the upcoming budget season. He put out a press release saying how hard he was pushing the heads of state departments to find cuts to make, and sat for press interviews. He promises deep cuts in services, and wants to lay off 1,000 state employees. (When he said something similar last spring, it turned out that no member of his administration had actually identified 1,000 employees whose services could be dispensed with. Instead it appeared his office had simply picked a number from a hat, and then complained when no one in the legislature took the proposal seriously.)

As he frequently does, the Governor took some time to claim that the blame for the budget situation belongs to the legislature, who rewrites the budgets he submits. In a newspaper interview last week, he is quoted as saying, "I can propose some things, but the General Assembly has to enact it and they enacted a budget that... is not a budget that works."

The Assembly is far from blameless for the current disaster of a state budget, but he is far too modest. Without his able leadership, we wouldn't be in nearly as serious a crisis. To hear him speak, you'd think that the budgets he submitted were models of fiscal responsibility, vandalized by evil legislators, but that just isn't true, and it hasn't been since the day he was sworn in.

Rhode Island is constitutionally forbidden from running a deficit in the current year. But there is nothing that says we can't write a budget that will create a deficit in the following year, and we do that all the time. Budget folks call this the "structural deficit". The Governor's first budget proposal, for the 2004 fiscal year predicted that, if enacted exactly as proposed, it would create a deficit of $23.8 million in 2005. For 2005, his own budget office predicted his budget would create a $68.9 million deficit in 2006. In 2006, they predicted a $98.5 million deficit in 2007, in 2007, they guessed $134.6 million in 2008, and in 2008 (the fiscal year we're currently in) they predicted a deficit of $379.2 million in 2009. That's a jumble of numbers, but here's the bottom line: the structural deficit was $23 million in Governor Carcieri's first year, and it's $380 million now. The situation is sixteen times worse than it was when he took office.

These are not numbers passed by the Assembly. These are numbers created by the Governor's own budget office about his own proposals for a state budget. No one forced him to propose a budget with a structural deficit. He owns these numbers, and what they say is that every year of his term, he has presented a budget that has led us further down the abyss we're in. They say that his administration is fully aware of the problems we face, and yet for five years has chosen to do approximately nothing to address them. This is leadership?

The fact is that Rhode Island faces a number of serious challenges, only one of which is the cost of our government. The cost of housing is too high, the wages to low-end jobs are too low. The cost of health care is way too high, and the support we give to public education is way too low. The price of gas is going up and up, and the buses can't handle the new demand. What has the Governor done -- or proposed to do -- about any of these problems? A zeal to cut taxes has driven almost every policy decision he's made, and in doing so, he's completely punted on addressing anything else.

You tell me that high taxes are the number one priority? I'll reply that a typical family in Rhode Island is paying around $1,500 more for gas in a year than they were five years ago. They and their employers are paying 35% more for health insurance than they were in 2001, after discounting for inflation. Rents are up so much that more than one household in six pays half their income for housing. Tuitions are up for our public colleges, and the cost of child care has increased, too. These are all problems that our government could address if it chose to. But instead our "leaders" worry about where to cut more. We are on schedule to cut the income taxes of our wealthiest citizens yet again this coming year. Which of these problems will that address?

(Some references are available here: Gas prices Also see PADD 1A here. Health insurance.)

15:51 - 01 Oct 2007 [/y7/cols]