What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Tue, 25 Sep 2007

For those who are wondering about the source of the fake statistic that says RI raised its taxes higher last year than any other state, it's in a report available to National Conference of State Legislators (NCSL) members at the ncsl.org.

The issue is that NCSL researchers counted as a new tax a tax that's been on our books for a dozen years or so. But for reasons that elude rational explanation, every year, the legislature passes it with a one-year expiration. Optimism, I guess. So it's not at all a new tax (and was even trimmed slightly this past session), but NCSL counts it as a new tax.

You can find the report right here, too, for free. Enjoy.

Update: The NCSL is upset that their report is being circulated for free, so have demanded that I retract it from the web site. For the moment, the link above won't work. However, I will be submitting a request that they allow me to display a representative segment that will allow readers to see that it was, indeed, their report that was the source of this stupid statistic.

Further update: No dice on reproducing even a part of the offending report, so go pay them their fee if you want to see their error instead of hearing me describe it. They also request that I clarify that they only charge a fee if you're not a legislator or staff. The rest of us who care about how the business of our state is conducted have to pay. If you're really curious, write me and I'll describe it to you. Read more here.

23:37 - 25 Sep 2007 [/y7/se]

Wed, 19 Sep 2007

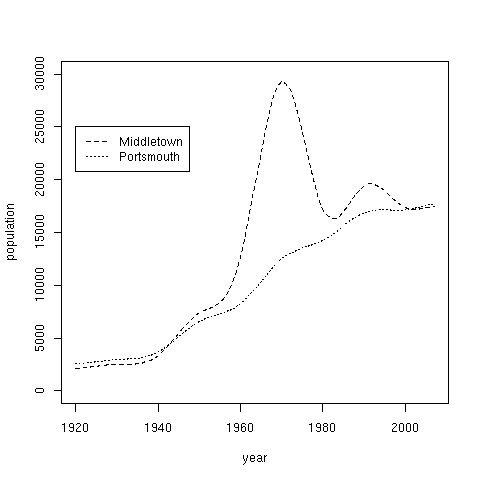

Does the movement of people from one town to another cause property

taxes to go up? Here's a chart of growth in Middletown and

Portsmouth, two towns right next to each other, on the same island.

They are the same size, and have the same tax rate (roughly), but

fiscal politics is brutal in Portsmouth, and the town teeters on the

edge of fiscal crisis. Middletown had a crisis a few years ago, but

now has one of the highest bond ratings in the state.

The two towns are now growing at the same rate, but for one of them, that's a relief to be growing after some years of shrinking. For the other, it's a disaster because they aren't growing at the explosive rate of years past.

There's more on the topic in issue 25.

21:58 - 19 Sep 2007 [/y7/se]

Can't get a break, even when they give them.

[Appeared in the RIMG papers last week.]

A few weeks ago I met a guy, a Republican who shall remain nameless here, out of kindness, since he's not a public figure yet. He's thinking of running for the state senate next year, and in conversation, he told me that part of the reason he's running is that Rhode Island raised taxes more this past spring than any other state. This is, of course, ridiculous, the kind of non-fact that deserves to be laughed out of the room whenever it comes up.

You've got to pity some of our leading state policy makers: Bill Murphy, the Speaker of the House, Steven Costantino, Chair of the House Finance Committee, and Gordon Fox, House Majority Leader. With the Governor's happy cooperation, they have engineered several years of tax breaks for the wealthiest citizens of our state. Putting aside their partisan differences, together they have brought our state, along with its cities and towns and school districts, to the brink of bankruptcy by easing the heavy burden on the richest of the rich. And yet, try as hard as they have, out comes a report from the National Conference of State Legislatures that says that Rhode Island raised its taxes more than any other state in 2007. Some people just can't catch a break.

The NCSL report ("State Budget and Tax Actions 2007", available at www.ncsl.org for members only and on mine for anyone who wants it) is quite clear: Rhode Island is the only state that raised taxes by more than 5% (page 9). What a scandal.

Well maybe it would be a scandal if it had really happened. Some years ago the state established a hospital licensing fee. For reasons that remain unclear, the original legislation back in the 1990's made the fee expire in a year. But the very next year, the budget writers felt that balancing the budget required that money, so the Assembly tucked it into the budget bill and passed it again the next year. Then they did it again the same way the next year, and the next and the next. So this is a tax that's been in place for a dozen years or so, even though it has been passed each year as a one-year extension. The fee raises a fair amount of money; the total expected this year is around $78 million, between 2% and 3% of the taxes the state collects, depending on how you count.

When the NCSL researchers were compiling their report, they saw that the tax was passed this spring, and so they counted it as a tax increase. What's really funny is that the Assembly actually *cut* this tax slightly, lowering the rate from 3.56% of patient revenues to 3.48%. (This brings their revenue forecasts into some question, but that's a story for a different week.) So that's how we wound up on the top of the list of tax-raising states this year: by mistake.

In defense of the NCSL report, it does point out that there were plenty of hidden tax increases in this year's state budget. Just about every fee the state demands was increased, from tuitions at the state colleges to car registration fees to license fees for building contractors. In total, the fees collected by all the different state agencies went up by a quarter to over $70 million. It's silly to claim this isn't a tax increase, and it's to the NCSL's credit that they refused to fall for that ruse.

But being right on this count doesn't excuse them from being so wrong on the other. The fact remains that sloppy work by NCSL researchers mistakenly transformed a minor tax cut into a massive increase in an authoritative-sounding report. And this is what will happen with that mistake. People who think that any government is too much government will take this non-fact created by the NCSL researchers, and shout about it, everywhere. You'll hear it in letters to the editor, in speeches by candidates for office, on talk radio shows, in clever asides in newspaper articles and in conversations with your friends. It will become part of the accepted wisdom, the stuff that "everyone knows." And the constant repetition will make it nearly impossible for legislators to do the right thing by our cities and towns next year, and so your property taxes will go up again, your school services will be cut again, your roads will remain unfixed.

So this is what you need to do: whenever you hear a politician or friend use this statistic, you need to laugh and ask if they've always been this gullible. Remember, it doesn't matter whether you support the hospital licensing tax or not. We're talking about correcting matters of fact, not opinions about taxes. The only way our state is ever going to have a rational discussion about any kind of policy is if the misconceptions are thrown out the door, so be ruthless. And laugh loud.

21:58 - 19 Sep 2007 [/y7/cols]

Fri, 07 Sep 2007

Paying for war with your school budget

[Appeared this past week in the Woonsocket Call, Pawtucket Times, and several other papers in the RIMG group.]

Over the last several years, the cost of educating our children has been the major driver of the rise in property taxes in Rhode Island. The biggest part of the rise -- by far -- has been the cost of special education. According to state department of education numbers, general education costs rose an average of 48% between 1998 and 2006, while special ed costs went up 83%. As of the 2005-2006 school year (the latest year published on the Education Department web site), we spend $444 million to educate these children out of nearly $2 billion for all the state's' public schools.

In 1975, Congress passed the Education for All Handicapped Children Act, now known as the Individuals with Disabilities Education Act (IDEA). This was the landmark legislation that established that the policy of our public schools would be to teach children with special needs in the same classrooms as everyone else, wherever possible. Where it isn't possible, the policy is to teach them in the same buildings as everyone else, and where that isn't possible, it's the school district's problem to pay for that child's education somewhere else.

It's a noble goal, but the problem is paying for it. In the past, children with serious education problems were shipped off to institutions like the state-run Ladd School. The current policy is a great step forward, but one can't help but notice that when the Ladd School closed, the savings in the state budget was not redirected to local school districts.

The state is an offender in this regard, but it is only a penny-ante player compared to the federal government. When IDEA was created, it established the laws that now rule special education. It was quite clear that the laws would create big financial burdens on states and local school districts, and the only way that it got through Congress was by including a promise to fund 40% of the costs of the new special ed rules and programs. All fine and good, of course, until you realize that now, 32 years after the law was passed, the federal government only funds 17% of the costs of this law.

Gerald Ford signed the bill into law, and the first year, the federal government paid 5% of the costs. The level climbed to about 12% by the time Jimmy Carter left office. Under Reagan, it slipped back to 8%, where it stayed, more or less, until 1993. During the Clinton administration, the level advanced to 14%. Progress continued after George Bush rode into town, until we started the Iraq war, when it stalled at 18%, and has backslid since.

This all seems a little abstract, so let's talk dollars. If we now fund 17% of special ed costs, and the goal is 40%, then what is that amount really? It's $13 billion, which seems like a lot of money, but is equivalent to about 41 days of what we are currently spending in Iraq. Rhode Island's share would be about $46 million, or about three and a half hours or Iraq spending. This week, Bush intends to ask Congress for another $50 billion to fund the war. That's a supplemental request, to go on top of the $147 billion he already requested, but hasn't been approved yet. To date, we've spent over $447 billion. (Check out the ticker to the right for more.)

So there you have it. Next time you're moaning about your property tax bill, remember that the fastest-growing part of the expenses it pays for are expenses that the Federal government was supposed to pay for, but doesn't, because of the war and the Bush tax cuts. (And we haven't even mentioned the costs of No Child Left Behind.) The added expense would be a drop in the federal budget bucket, but it's a major burden for your town.

But it's all tax money, you say. Who cares if it comes from federal taxes, state taxes, or property taxes? You do, and the reason is who pays those taxes. Income taxes are higher on wealthy people than on poor ones, and property taxes are exactly the reverse, with poor and middle-class people paying a much higher percentage of their incomes on property taxes than the rich. According to the Tax Policy Center in DC, the Bush tax cuts on the wealthiest half percent of our citizens were worth over $100,000 in 2007. When he refused to increase the funding for IDEA, he made your property taxes higher, because federal law still requires those special ed programs. That's the way it works these days, at the federal, state and local levels: the interests of the poor and the middle are routinely sacrificed for the interests of the wealthy. This sounds like rabble-rousing, but it's right there in the numbers if anyone cares to argue about it.

In 21st Century America, the military is not drawn from a cross-section of our world. Lots of people don't even know anyone who's been in combat. But the war still affects all of us, and one place you can see it is in your property tax bill.

23:53 - 07 Sep 2007 [/y7/cols]

Thu, 06 Sep 2007

Bureaucracy creeps, enrollment drops

A recent Projo article documents how increasing the qualification requirement paperwork for RIte Care (Rhode Island Medicaid) has resulted in an "unprecedented" drop in people in the program. They've gone from 119,000 people to 111,000 since January 2005. Those missing 8,000 people were not all people who didn't "deserve" to be served by the program. Some of them were people who would qualify, but who weren't up to the challenge of providing all the necessary paperwork -- birth certificates, four pay-stubs to verify income -- and so on.

I wrote a while back about the welfare bureaucracy and the insane fear that someone, somewhere, will take advantage of the system to get benefits for which they are not entitled. To be clear, this is a bad thing, and to be avoided, but when the cost of avoiding it is that people who need help also get cut off the rolls, then there is something seriously wrong with the system. Read more here.

12:06 - 06 Sep 2007 [/y7/se]

Wed, 05 Sep 2007

Do you want to know why we're in Iraq now? Read here.

The Daily Howler is right that this is the story that refuses to be told. You'll see it in the link above, but it won't resonate or echo anywhere, and so you won't hear it until the next time someone publishes a story about press misconduct.

Trying to figure out what to do about this isn't easy. Heaven knows my answer isn't so effective. But it is pretty clear that nothing will happen so long as people don't mention it.

13:19 - 05 Sep 2007 [/y7/se]

From Bill Maher (via Cheers and jeers):

And finally, New Rule: If you were surprised that the Chinese don't care about toy safety, then the child who needs protecting is you. Over the last couple of months, American consumers have been learning a shocking lesson about supply and demand: if you demand products that don't cost anything, people will make them out of poison, mud and shit...

They're the Chinese. They don't care if your precious little Britney sucks a little lead. Because in China, their kids aren't playing with the toys. They're the ones in the factory all day making them.

Now, I know you're saying, "But, Bill, I don't have time to ponder whether these $12 jeans are the product of child labor. I just know I'm an American on a budget and our lifestyle is a blessed one. And I want to look nice while I'm standing in line for my iPhone."

But, there is something to be said for thinking about why these bargains are such bargains. Wal-Mart is the most American thing in the universe, but all it sells is crap from China. Wal-Mart wouldn't exist without the American consumers' endless thirst for the cheapest stuff China has to offer. Like $30 DVD players and Jackie Chan. Yeah, you're right, it was a great movie.

Anyway...in America, there is nothing more sacred than a bargain... And Jackie Chan. And that even includes the war. Yeah, there's too much lead in the kids' toys, but not nearly enough on the Humvees in Iraq. "Let's have a war and cut taxes; what could go wrong?" "Let's give mortgages to the homeless. Sounds like a plan." "Let's buy toys from a Communist police state. You just know they'll put in a little extra love."

Speaking of which, you know why today's modern Chinese capitalist puts lead in the paint that goes on toys? Because it makes colors brighter. You've got to love America, a country that's literally being killed by the stuff that makes objects shiny.

09:24 - 05 Sep 2007 [/y7/se]